【Income Tax on Lump-sum Withdrawal Payments】Twincities Labour & Social Security Consulting

2024/06/28

Lunp-sum withdrawal is applied to National Pension (hereinafter, referred to as NP) and Employees' Pension Insurance (hereinafter, referred to as EPI), which non-Japanese people can claim when they leave Japan

The condition is that they have paid at least 6-month amount of insurance fee for NP, or that they have paid insurance fee for at least 6 months for EPI.

The sysytem of income tax on lump-sum withdrawal is different between NP and EPI.

Income tax is not deducted from lump-sum withdrawal of EP, on the other hand, income tax is deducted from that of EPI by 20.42%.

Income tax on EPI's lump-sum withdrawal may be refunded, however, by submitting "Tax Return for Refund Due to Taxation on Retirement Income at the Taxpayer's Option" to the tax office.

To claim tax refund, it is necessary to desigmate the tax agent by submitting the document of "Notification of Tax Agent for Income Tax/Consumption Tax" (所得税・消費税の納税管理人の選任・解任届出書) before or on claiming tax refund.

(Click here to download the document.)

The only condition of tax agents is that they live in Japan, and do not have to be tax accountants.

I reccommend deciding who to assign the tax agent to before they leave Japan.

---

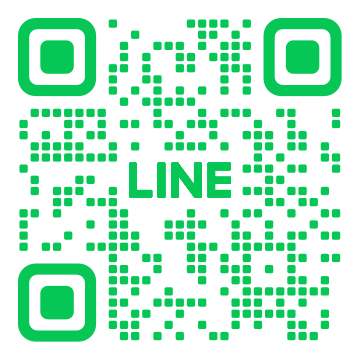

Our office accepts inquiries from the application of LINE.

Read this QR code and feel free to make an imquiry.

----------------------------------------------------------------------

ツインシティズ社労士事務所

〒812-0054

福岡県福岡市東区馬出1-23-25-1 コーポウィング101

電話番号 : 092-632-5480

FAX番号 : 092-631-0620

未来のため脱退一時金を福岡市で

----------------------------------------------------------------------